Cryptocurrency Buying And Selling Hours Are Crypto Markets All The Time Open Ifcm India

To comprehend why the cryptocurrency is so unstable, you must first comprehend the character of volatility itself. If your goal is to construct long-term wealth by way of https://www.xcritical.in/ crypto, you don’t have to worry about short-term market movements. On the opposite hand, entry and exit timings are important if you would like to accumulate cash for short-term needs. Moreover, nothing is fixed in the crypto world, which is the problem when finding the right time to purchase cryptocurrency. Something true today may not be relevant tomorrow, and no one can predict the future.

Q Is It Higher To Trade Crypto Assets Throughout A Specific Time Of The Month?

However, it continued to commerce unstable and was at present beneath $29,500. Bitcoin’s dominance is at present at forty four.50%, an increase of zero.17% over the day. Cryptocurrencies have been in the headlines since their creation, with regards to excessive volatility to the collapse of several business giants, amongst them on top of the FTX trade platform case. Cryptocurrency has become the proverbial elephant in the room — inconceivable to miss, consultants agree. With huge amounts of capital flowing into the market, regulators can not afford to show a blind eye.

Bitcoin Worth Hits Report $75,000 For The First Time Here’s Why

Before buying crypto from any change, its buying and selling quantity must be assessed. Cryptos with high volume are straightforward to trade as they’re highly liquid. On the opposite hand, low-volume crypto refers to low liquidity, higher slippage, and better price. It could be the proper time to enter the market as fundamentally robust assets would be available at a discounted worth. So for crypto the idea was that any weekend activity was ‘wrong’ and worth fading.

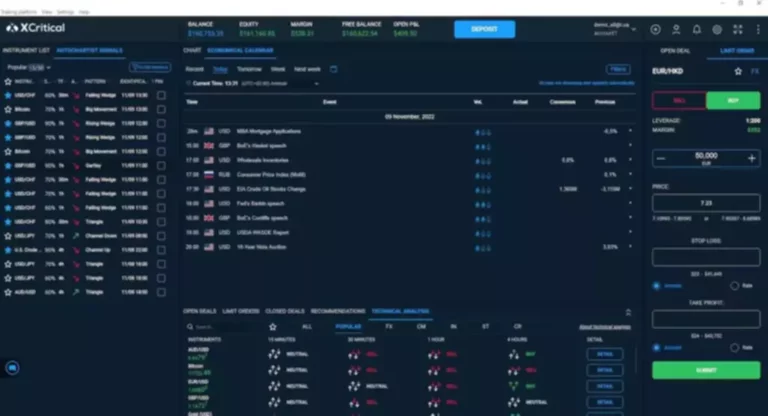

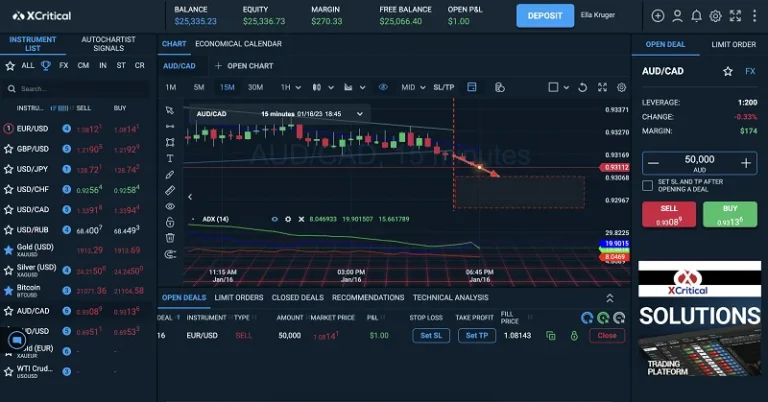

Tools Used For Crypto Market Trading

Also, this method is straightforward on your pocket as you don’t have to take a position a considerable quantity in one go. However, to place it simply, given crypto volatility, there is not a right time for getting a crypto coin. Investors work their method around this problem by following a few strategies.

You can achieve the very best and most affordable returns from this strategy. You clear away from emotional trading the place psychological factors like pleasure or concern come into play. It is a a lot more disciplined technique that lets you keep away from overbetting or panic promoting throughout occasions of turbulence.

Transactions are peer-to-peer and facilitated by blockchain know-how, which permits buying and selling to happen around the clock. At current, the total volume in DeFi stood at $13.91 billion, 15.23% of the entire crypto market 24-hour quantity. Further, the quantity of all secure cash is now $81.thirteen billion, which is 88.84% of the entire crypto market’s 24-hour volume.

They have additionally onboarded Gautam Gambir as model ambassador and launched a model new campaign called the Crypto Coach, to assist Indians navigate the market safely. But every thing changed when Donald Trump received the election to turn out to be the next President of the United States. His victory acted like a steroid to the cryptocurrency market, injecting it with a surge of renewed interest and fervour.

- “Bitcoin is not just one other token or a speculative asset class, but gives you confidence that your money has also grown.

- By understanding these seven key factors and approaching your investments with caution, you’ll be higher equipped to navigate the crypto world confidently.

- The cumulative m-cap of the Adani group shares dropped by ₹1.86 lakh crore to ₹12.42 lakh crore from ₹14.28 lakh crore on the finish of commerce on Wednesday.

- Most importantly, they want to pay consideration to the tax repercussions of their Bitcoin transactions and make certain that they conform to all related tax guidelines.

The best time to buy cryptocurrency is when you are emotionally and financially ready. Anyway, you must do your personal analysis, bear in mind prices can go down as nicely as up and by no means make investments more cash than you possibly can afford to lose. But if you reside in a state like California, it may be easier to access crypto exchanges. It just is dependent upon what state you reside in, and what exchange you want to use. Now that you’re getting used to setting your alarm bright and early to look at cryptocurrency developments, you might begin to note longer patterns from week to week.

He says the pro-crypto stance of US President-elect Donald Trump and changing political dynamics have reinvigorated investor sentiment across the crypto sector. «The reversal of ETF outflows, with $850 million in internet inflows over two days, reflects growing confidence in Bitcoin,» he provides. “Bitcoin is not just one other token or a speculative asset class, however offers you confidence that your cash has additionally grown.

Savvy crypto buyers perceive the existing regulatory panorama and constantly observe up on future developments. The offers that appear on this site are from firms that compensate us. But this compensation does not influence the knowledge we publish, or the critiques that you just see on this site. We don’t embrace the universe of firms or monetary provides that may be available to you. Buying cryptocurrency requires people to make use of a crypto wallet that can interact with the blockchain that tracks cryptocurrencies.

Bankrate.com is an unbiased, advertising-supported writer and comparability service. We are compensated in trade for placement of sponsored services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order merchandise appear within listing categories, besides where prohibited by regulation for our mortgage, house equity and other house lending merchandise. Other factors, similar to our own proprietary website guidelines and whether or not a product is offered in your space or at your self-selected credit rating range, also can impression how and where merchandise appear on this site. While we strive to provide a variety of offers, Bankrate does not include information about each monetary or credit services or products.

Here’s a take a look at how crypto market hours work and what you need to know before investing. Cryptocurrencies don’t must be traded on any type of central trade because they operate on the blockchain, making them obtainable for purchasing and promoting 24/7, three hundred and sixty five days a year. Pricing trends carry on as weeks flip into months, and new buying and selling patterns emerge that elevate and lower the price of assorted cryptocurrencies over time.

Trump additionally introduced in September that he, along together with his sons and entrepreneurs, will launch a digital forex platform named World Liberty Financial. But it had a faltering gross sales launch earlier this month with a fraction of tokens that went on the market discovering a purchaser, as per the company report. Lending under Margin Trading Facility (MTF) went up in October 2024 to a report high level of over ₹80,500 crore, as per the change knowledge. Vikram Subburaj, CEO, Giottus Crypto Platform, says Bitcoin’s journey toward $100,000, as soon as considered formidable, now appears more and more inside reach.