Payroll Software for Small Businesses

I could click “resolve exceptions” to work out these issues before running payroll. Based on what I was able to play with in the platform, Gusto guides you through payroll and benefits management in a way that makes these processes less overwhelming. You can be sure you’re completing tasks in the right order without missing a step. I found the process payroll bookkeeping of setting up a payroll schedule pretty easy. You simply choose a schedule—Gusto automatically suggests one for you—and confirm state tax details based on where employees are located. When I asked a customer service representative about this, they said that this simply shows that the vacation time is already included in the payroll run.

Create Detailed Accounting Reports

It offers payroll tools for W-2 and 1099 workers and automatic tax payments and filing (with an error-free guarantee) and more. If you are running payroll manually, the process will be important to ensure that you don’t overlook any critical detail when processing payroll. When setting up the process, determine a pay schedule that you will stick to. Typical pay schedules are weekly, biweekly or semimonthly.Have a process for tracking work time. You may have a time clock or use a computer program to log time. Whatever you choose, train your employees on tracking their work time properly to get paid correctly.

What are payroll services?

They issue and process employees’ pay, commissions, or benefits. They also ensure all the information adheres to local, state, and federal guidelines and policies. You can record your payroll system’s transactions, income, and expenses using reliable accounting software. And as long as you do everything according to the law and on time, your whole accounting system will thrive in no time.

Essential Features

Figure out how much you will pay and how much employees will pay. You’ll need to account for these deductions when processing payroll and send money to the correct benefits program. Payroll processing is the method you follow to pay employees at the end of a pay period.

- The calculation of payroll is highly influenced by each country’s legal requirements (it may also depend on state or local city requirements).

- If payroll isn’t automated, you have to run it manually on schedule a couple of days before payday, entering worker pay amounts and scheduling paydays.

- Payroll accounting refers to an organization’s record of an employee’s compensation, including benefits, payroll taxes and money deducted from wages.

- Some of the payroll services we review go well beyond these basics and can work for larger organizations, but we focus on small businesses and their payroll needs.

- Hold times are often long for support specialists, even during setup or when trying to correct problems with initial pay runs.

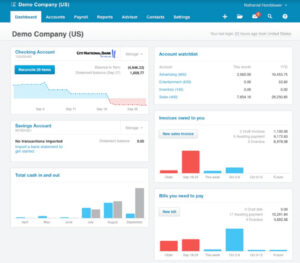

Why QuickBooks

- After you pay these wages, you’ll make reversed entries in your ledger to account for this payment.

- The forms will tell you how much of an employee’s wages you should deduct each pay period.

- Frank’s Auto Repair uses technology to stay current and keep its customers’ cars on the road and running smoothly.

- I felt like the company was genuinely interested in helping me rather than selling anything.

We gave you some tips in prior steps to help check yourself along the way, but a payroll reconciliation is a more in-depth approach. Check the numbers against the data you gathered from your payroll system. https://www.bookstime.com/ Does the total gross wage expense entry tie to your total payroll expense for the period? Be sure to confirm that your debits equal your credits (basic accounting systems should confirm this).

Payroll software for accountants

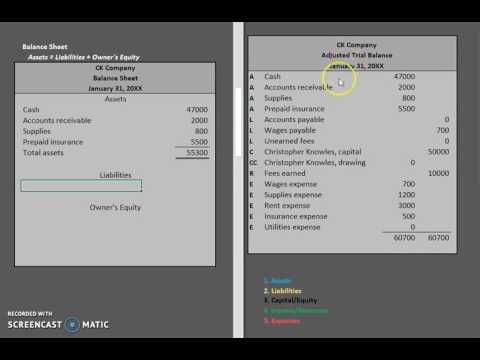

The accrued payroll account houses any net payroll amounts (payable to employees) that have been expensed but have not yet been paid. When recording payroll, you’ll generally debit Gross Wage Expense, credit all of the liability accounts, and credit the cash account. Gross Wages will appear on your Profit and Loss or Income Statement, and the liability and cash accounts will be included on your Balance Sheet. Recording payroll on your books involves making sure that amounts are accurately posted to payroll accounts. Before you can record payroll, you will need to set up payroll accounts on your chart of accounts list. Based on this calculation, $1,900 is the net pay for this employee.

QuickBooks Payroll

This information is used to create financial journal entries recorded on a GL for financial reporting and business-related purposes. Most small business owners will not create an entry for this type of liability because employees are paid shortly after the pay period. However, it’s important business owners monitor their accounts around payday to make sure there’s enough money for payroll and any tax payments.

- It doesn’t include rent, utilities, equipment, inventory, or any other business expenses unrelated to employee compensation or benefits.

- A liability is an amount you owe, while an expense is an amount you’ve already paid.

- We then scored these contenders across 34 metrics in five categories weighted to favor features that small business owners find valuable in a payroll provider.

- It automatically calculates, deducts, pays, and files your payroll taxes at the federal, state, and local levels, helping you ensure your business stays compliant with all applicable tax laws.

- It has tiered plans with payroll by direct deposit, a self-service employee platform, new hire onboarding and optional benefits administration for additional fees.

Employee paid time off