What Is Invoice Factoring And How Does It Work?

Invoice financing and invoice factoring are two similar types of business financing, but they aren’t exactly the same. With invoice factoring, your outstanding invoices are sold at a discount to a third party known as a factor. The factor then becomes responsible for collecting payment from your customers. Once the factor is paid by your customers, the factor pays you back the difference between the amount they advanced you and the full value of the invoices, minus a factoring fee. Invoice financing is a type of business loan that’s made based on the value of your outstanding invoices.

What is the meaning of invoice finance?

ABL is often used by businesses that have valuable assets but need access to working capital for various purposes, such as expansion, operations, or managing cash flow. Unfortunately, these options can be predatory (e.g. lenders that charge triple digit interest) and put your business into a financial hole that’s difficult to climb out of. It’s generally not a good option for businesses with few invoices, or with clients that are severely delinquent. Invoice financing companies can charge fees in different ways, but usually they charge a flat percentage (1% to 5%) of the invoice value.

Allianz Trade Global Survey

- To qualify for invoice financing, you should have creditworthy customers who have a history of paying on time.

- To make an informed decision, carefully consider their strengths, limitations and specialized services that align with your business needs.

- This can be a good option when you don’t want a long-term loan or you can’t get approved for conventional business loans.

- The financing company advances a percentage of the invoice value upfront and charges interest.

- Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range, can also impact how and where products appear on this site.

- While some lenders have a working capital loan specifically, you can use other loans to boost your working capital.

In some instances, the perpetrator behind a fraudulent invoice is someone on the inside, such as an employee. Unlike an outsider, employees are far more familiar with the company’s inner workings, including key processes like the B2B payment approval flow and the financial systems used (ERP, vendor databases, etc.). This knowledge makes internal bad actors more apt to sneak in fraudulent invoices unnoticed. For a homeowner getting work done on the house, it’s common practice to price out options and find the vendor who can do the best job at a fair price that will stay on budget. In the business world, many companies lack oversight of pricing agreements and fail to benchmark what they are paying versus current market rates. When these relationships aren’t checked regularly, vendors can take advantage and begin overcharging.

The Bankrate promise

Invoice financing is a funding solution that allows businesses to access immediate cash flow by using their outstanding invoices as collateral. Rather than waiting for customers to pay their invoices, businesses can sell them to a financing company at a discounted rate. When you use invoice discounting, your lender gives you an advance payment invoice financing of capital based on the amount of revenue expected from your unpaid invoices. This means that invoice financing is less risky for lenders, as compared to other types of financing such as an unsecured line of credit. Small business owners can often find themselves in a tricky position when their customers take too long to pay invoices.

Accounts receivables financing helps manage outstanding invoices by providing immediate cash flow based on the value of unpaid invoices. By converting accounts receivable into cash, businesses can meet immediate financial obligations, invest in growth initiatives, and avoid the negative impacts of late payments or cash flow gaps. Like invoice financing, lenders give you a cash advance worth a percentage of your outstanding invoices.

- Accounts receivable financing is short-term, with repayment typically falling within a 3-6 month window.

- You can have all the software comparison guides in the world available to you, but if you aren’t intentional about your decision, you may end up choosing software that falls short for your needs.

- As with any type of debt, if your client doesn’t pay the invoice, you may be required to repay the advance or loan you received.

- With Meta and Google Ads integrations, plus powerful receipt matching, expense management suddenly becomes easy.

- They help businesses maintain stable cash flow, manage expenses, and seize growth opportunities by converting accounts receivable into immediate working capital.

- Invoice factoring and invoice financing are two different ways to receive the funds for an invoice before the client pays.

An invoice financing company advances you a percentage of the invoice value in exchange for a small fee. You still own the invoice and have to collect payment for it, but you’ll receive the money you need in the meantime. Invoice financing and invoice factoring let you use unpaid invoices to generate quick cash, making them useful if your working capital is low as you wait for more money. The lender also limits its risk by not advancing 100% of the invoice amount to the borrowing business. Invoice financing does not eliminate all risk, though, since the customer might never pay the invoice. This would result in a difficult and expensive collections process involving both the bank and the business doing invoice financing with the bank.

Apply for a loan

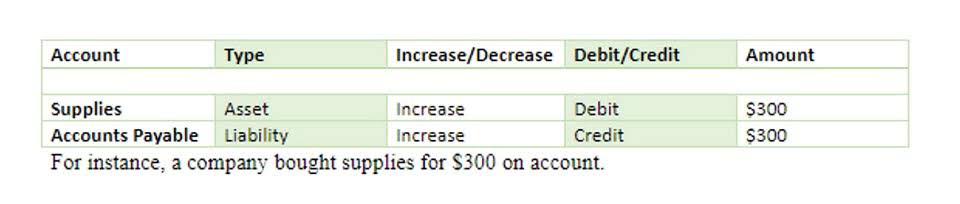

As customers pay their outstanding invoices, the business uses those funds to repay the loan. Lastly, some smaller businesses that don’t have access to traditional financing may turn to other alternative short term lenders out of desperation. Invoice discounting is the traditional form of invoice financing and you https://www.bookstime.com/ may see it referred to simply as invoice financing or accounts receivable financing. Invoice discounting is a type of revolving loan that is secured by your accounts receivable. Invoice financing often makes sense when a business needs to get funding more quickly and can’t qualify for less expensive financing.